Gambling Winnings And Losses On 1040

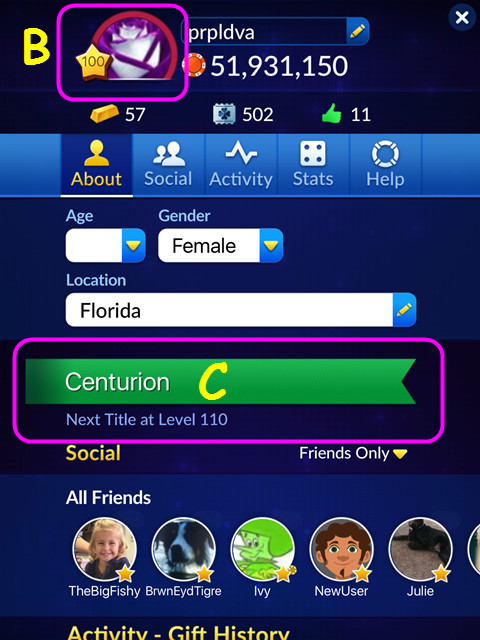

Recently I was asked to review a return for a new client. He is a professional gambler and he wanted to make sure his previous tax preparer entered the information correctly. This gave me a perfect opportunity to present a case study to compare the differences between reporting as a person who gambles a few times a year with a person whose main activity during the year is gambling as a professional.